Saturday, March 14, 2020

Tuesday, March 10, 2020

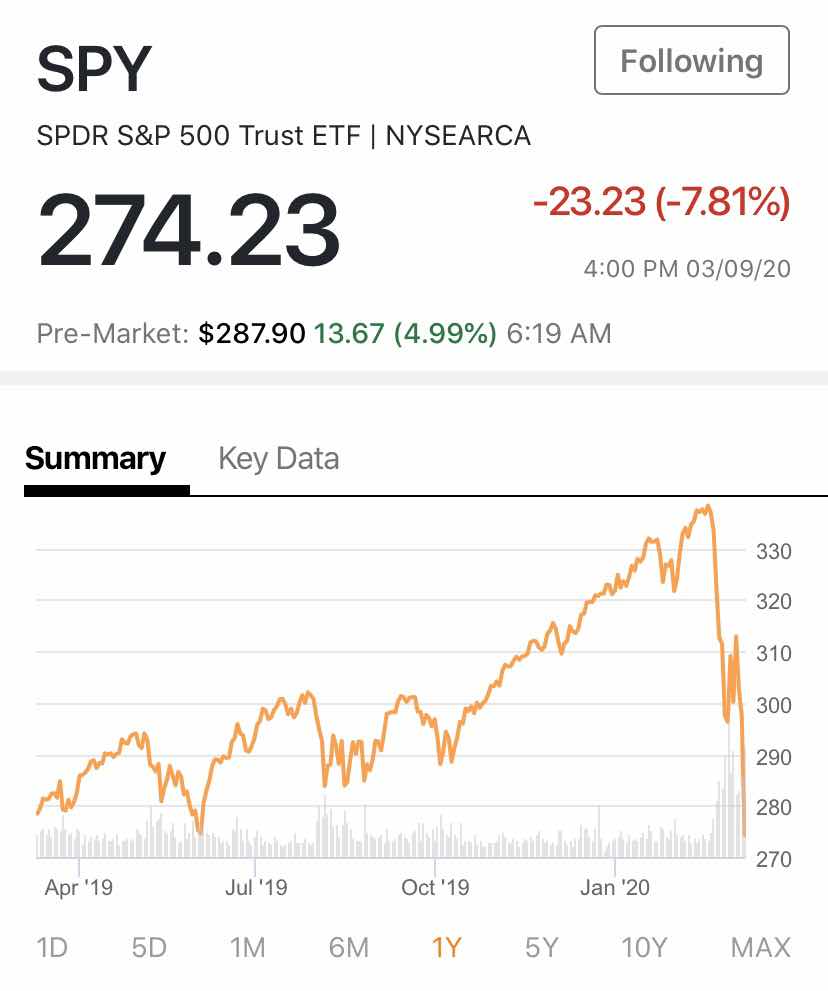

S&P 500 Corrects 7.5% to 2740 - Values Abound for Long Term Investors

S&P 500 Corrects 7.5% to 2740 for a total correction of 19% from 3394. Admittedly this correction is from an elevated level and there is near term uncertainty due to COVID-19 impact on economy. However for Long Term Investors Values Abound in the market including highest quality companies trading at attractive valuation, especially compared to 0.6% yield on US 10 Year Bond Rate.

A snap back of US 10 Year Yield above 1% and containment of COVID-19 Virus are catalysts needed to signal the bottom on this correction.

SPY 1 Year Chart

SPY 5 Year Chart

Blackstone in talks for $4B deal to take SOHO China private ($8.7B Enterprise Value Including $5.7B Debt)

Blackstone in talks for $4B deal to take SOHO China private ($8.7B Enterprise Value Including $5.7B Debt). BX will pay a 100% premium to depressed share price for this office developer.

Blackstone in talks for $4B deal to take SOHO China private

Blackstone in talks for $4B deal to take SOHO China private

Sunday, March 8, 2020

Oil Set to Crash to $32 per Barrel as Russia and Saudi Arabia Declare War on US Shale

After OPEC and Russia failed to agree on Oil Cuts WTI and Brent are set to open $10 lower to $32.

Oil Price 70 Year Chart

Friday, March 6, 2020

Updated Thoughts on Corona Virus Impact on Economy and Stock Market

Updated Thoughts on Corona Virus Impact on Economy and Stock Market

As the fear, psychology and change in customer behavior takes deeper hold due to Corona Virus affecting Travel, Leisure and other industries, I think Impact on Economy and Stock Market could be more than I initially anticipated.

It is a fact that regular flu (Influenza Virus) will kill multiple times more people than Corona Virus, it also seems to be the case that human behavior to first one is ignorance but to the second one is fear. If this behavior of people cancelling vacations, business conferences, events at entertainment and sports venues continues there will be job losses in these sectors. The cutting of interest rates by US Fed to 0% is also stoking more fear in the market as long term bond yields fall with US 10 year at 0.8% and 30 year below 1.5% the stock market could tumble further down making new lows than Feb last week low of 2820 on S&P.

Time to hold on to your assets and ride out the turbulence in the markets that could last a while.

Contagion from fear will likely affects all sectors of the economy unless sentiment turns. Irony will be that it won’t be the Corona Virus that causes the recession but the human reaction and psychology to it that might.

Thursday, March 5, 2020

Blackstone’s India Plans - Steve Schwartzman Interview

Excellent Interview by Steve Schwartzman Founder and CEO of Blackstone (BX).

India’s Yes Bank Fails, RBI Takes Over Board

India’s Yes Bank has failed due to bad loans and RBI Takes Over it’s Board. India’s Banking Sector crisis and recession has been ongoing for last 2 years. A global recession could cause more trouble to Indian Banks where public sector banks hold billions of dollars worth of bad loans. Vulture Investors are ready to pounce when prizes assets are sold by the banks.

The government on Thursday imposed a withdrawal limit of Rs 50,000 for depositors of beleaguered private lender Yes Bank.

The government on Thursday imposed a withdrawal limit of Rs 50,000 for depositors of beleaguered private lender Yes Bank.

Berkshire Hathaway pulls out of $7B LNG project in Canada

BRK.B: Berkshire Hathaway pulls out of $7B LNG project in Canada

The Trudeau Liberal Govt continues to be a disaster in managing the Canadian Economy. Investment and Investors are fleeing the country like never before.

'Bond King' Gundlach says Fed panicked and rates are 'headed toward zero'

'Bond King' Gundlach says Fed panicked and rates are 'headed toward zero'

Jeff Gundlach CEO and Founder of DoubleLine Capital thinks US 10 year bond yield will head to 0% just like Euro and Japanese Govt bonds.

DoubleLine Capital is 20% owned by Oaktree which is 61.2% owned by Brookfield

CNBC: 'Bond King' Gundlach says Fed panicked and rates are 'headed toward zero'

Wednesday, March 4, 2020

Brookfield Infrastructure sweetens bid for Cincinnati Bell to $13.50 per share $2.8B Enterprise Value

Brookfield Infrastructure sweetens bid for Cincinnati Bell

Brookfield Infrastructure sweetens bid for Cincinnati Bell to $13.50 per share $2.8B Enterprise Value matching offer fro Macquarie Infrastructure and Real Assets.

Brookfield Infrastructure sweetens bid for Cincinnati Bell

Brookfield Infrastructure sweetens bid for Cincinnati Bell to $13.50 per share $2.8B Enterprise Value matching offer fro Macquarie Infrastructure and Real Assets.

Brookfield Infrastructure sweetens bid for Cincinnati Bell

Toronto Home Prices Surged 17% YOY Feb 2020 to C$910K - Closing In on Apr 2017 Peak Value C$921K

Toronto Home Prices Surge

Toronto Home Prices Surged 17% YOY Feb 2020 to C$910K Closing In on Apr 2017 Peak Value of C$921K. Number of sales were up 45% year over year in Feb 2020. With US Fed cutting interest rates by 0.50 to 1% and US 10 year bond at 1%, Bank of Canada was forced to follow suit with a 0.50% cut as Canada and US economies are tightly integrated. This has reduced the mortgage rates with first RBC lowering its Prime Rate to 3.45% from 3.95% and all other Canadian banks following suit. I believe Canadian House Prices will continue to be elevated until rates rise or a recession causes job losses.

Toronto Home Prices Surged 17% YOY Feb 2020 to C$910K

Toronto Home Prices Surged 17% YOY Feb 2020 to C$910K

Tuesday, March 3, 2020

US Fed Funds Rate Cut to 1%, US 10 Year Bond Yields 1%

Today US Fed Funds Rate was Cut to 1% after a reduction of 0.5% to counter impact of Corona Virus on the economy.

US 10 Year Bond Yield also dipped below 1% for the first time in history. It is looking like US 10 year bond rate may keep going down to yield 0% like Euro and Japan.

In this environment stocks which can produce 6-8% return over the long term look attractive with earnings yield spread of equities over bonds being +5%. Avoiding companies with exposure to travel and buying well capitalized companies with long term growth runway and competitive advantages is the way to go.

US 10 Year Bond Yield

Subscribe to:

Posts (Atom)