Apple, Microsoft top Dow 2019 standings; Walgreens wobbles to the bottom

Tuesday, December 31, 2019

Apple, Microsoft top Dow 2019 standings; Walgreens wobbles to the bottom

AAPL tops Dow gainers with 85%+ and MSFT lead with 55% gain. BA and WBA were the Dogs of the Dow.

Apple, Microsoft top Dow 2019 standings; Walgreens wobbles to the bottom

Apple, Microsoft top Dow 2019 standings; Walgreens wobbles to the bottom

Monday, December 30, 2019

Genesee & Wyoming Announces Completion of Sale to Brookfield Infrastructure and GIC

I expect this acquisition to turn out to be a multi bagger in a decade. Irreplaceable assets in Rail Logistics in US, Canada, UK, Europe and Australia where Brookfield has a footprint.

These assets are perfect for organic growth opportunities and leveraged returns will be 18-20% over the long term.

Genesee & Wyoming Announces Completion of Sale to Brookfield Infrastructure and GIC $GWR

Genesee & Wyoming Announces Completion of Sale to Brookfield Infrastructure and GIC $GWR

Monday, December 23, 2019

Brookfield Property Malaise?

Is Brookfield Property Properties (BPY) (BPR) suffering from Malaise? Brookfield made an offer for 66% of GGP that it did not own first in Nov 2017 and raised the offer to seal the deal in Mar 2018 and completed the acquisition in Sep 2018.

Early going has been slow with Brookfield not being able to divest any mall assets to reduce debt. There is too much fear in the market towards retail due to Amazon and eCommerce. Brookfield will need to create value the hard way here by redeveloping 7-10 malls at a time so that they can use cashflow generated from the mall assets to transition them to Live Work Play sites by adding residential towers and offices.

I think jury is still out on how this turns out and we will know the outcome 5 years to 10 years from now.

WSJ Article - Brookfield’s Bet on Malls Looks Riskier than Ever

Early going has been slow with Brookfield not being able to divest any mall assets to reduce debt. There is too much fear in the market towards retail due to Amazon and eCommerce. Brookfield will need to create value the hard way here by redeveloping 7-10 malls at a time so that they can use cashflow generated from the mall assets to transition them to Live Work Play sites by adding residential towers and offices.

I think jury is still out on how this turns out and we will know the outcome 5 years to 10 years from now.

WSJ Article - Brookfield’s Bet on Malls Looks Riskier than Ever

Brookfield Infrastructure to buy Cincinnati Bell in US$2.6B Deal

Cincinnati Bell Inc. (NYSE:CBB), together with Brookfield Infrastructure (NYSE: BIP; TSX: BIP.UN), today announced an agreement through which Brookfield Infrastructure and its institutional partners will acquire Cincinnati Bell in a transaction valued at approximately $2.6 billion, including debt. $530M will be Equity investment and includes taking over $2B of existing debt. CBB has operations in Cincinati, OH and Hawaii where it provides mobile services as well in addition to Cable and Internet. Brookfield will be able to bring scale to the business as it operates Wireless and Broadband services in New Zealand and operates Telecom Towers and Cloud Data Centers in US, France, Brazil, India, UK and France.

Brookfield Infrastructure to buy Cincinnati Bell in US$2.6B Deal

Cincinnati Bell Inc. To Be Acquired By Brookfield Infrastructure In $2.6 Billion Transaction

BIP Bolsters Data Infrastructure Portfolio with Cincinnati Bell

Hawaiian Telecom

Brookfield Infrastructure to buy Cincinnati Bell in US$2.6B Deal

Cincinnati Bell Inc. To Be Acquired By Brookfield Infrastructure In $2.6 Billion Transaction

BIP Bolsters Data Infrastructure Portfolio with Cincinnati Bell

Hawaiian Telecom

Friday, December 20, 2019

Worst Performing Stocks Of The Decade

Worst Performing Stocks Of The Decade in US Markets S&P 1500 honor goes to Telecom Company Frontier Communications. The rest of the list is mostly dominated by Energy Companies most of the failed ones operated with leverage. The list also included disrupted companies JC Penny, Fossil and mining and steel companies CLF and US Steel. In the mean time the S&P 500 Index returned 13% annualized over the decade.

Worst Performing Stocks Of The Decade

Brookfield acquires 3i’s Wireless Infrastructure Group stake for $500M

3i Infrastructure (3IN.L) is selling its 93% stake in Wireless Infrastructure Group (WIG) to Brookfield Infrastructure (BIP).The deal values 3i Infrastructure’s stake in the British independent wireless infrastructure operator at 387 million pounds ($506.08 million).

Brookfield acquires 3i’s Wireless Infrastructure Group stake for $500M

3i Infrastructure plc sells its stake in WIG

Brookfield acquires 3i’s Wireless Infrastructure Group stake for $500M

3i Infrastructure plc sells its stake in WIG

Thursday, December 19, 2019

S&P 500, Dow, Nasdaq Notch New Records

US Stock Indexes made new all time highs today on 19 Dec 2019. What a difference in sentiment a year makes. Also macro news comes and goes but good companies adapt and continue to grow value seems to be the theme. Ultra Low Interest Rates also are a factor.

Brookfield Is Considering a $1 Billion REIT Listing in India

Brookfield Asset Management Inc (BAM). is considering bundling its commercial real estate assets in India into a REIT for a listing next year. Brookfield is considering including about 15 million square feet to 20 million square feet to raise US$1 Billion. BX recently listed its India assets in a REIT and the listing is up 41%.

Brookfield Is Considering a $1 Billion REIT Listing in India

Brookfield owns the following Office Real Estate Properties in India:

MUMBAI

Equinox Business Parks

Powai Business District

Waterstones Business Park

New Delhi - GURGAON

Candor TechSpace, Sector 21

Candor TechSpace, Sector 48

New Delhi - NOIDA

Candor TechSpace, Sector 135

Candor TechSpace, Sector 62

KOLKATA

Candor TechSpace, New Town Rajarhat

Brookfield Is Considering a $1 Billion REIT Listing in India

Indian Stocks and Economy at Inflection Point

Indian Stocks and Economy at Inflection Point. India is poised to prosper and is at same point where China was 20 years ago. India is assured of a stable government for next 5 years and economic policies are favorable. Below are best and worst performing stocks in India for 2019.

Wednesday, December 18, 2019

Brookfield VLI Brazil Logistics Update

Brookfield purchases VLI Brazil Railroad, Ports and Logistics operator in 2015 from mining company Vale when it was in distress and looking to raise cash during a down cycle in the commodity markets. Brookfield paid $885M for its 26% stake. Brazilian Lira unfortunately depreciated significantly over last 4 years and Brookfield did not hedge their currency exposure. Inspire of this due to the quality of the assets and a good business growth plan and a turnaround in the Brazilian economy this investment is poised to do very well.

Brookfield Center Parcs UK & Ireland Update

Brookfield (BAM) bought Center Parcs UK from Blackstone (BX) in June 2015 for GBP 2.4B. Inspire of GBP depreciation the investment is poised to pay off due to development initiatives that have grown the company. Also lower interest rates in UK have made real property assets more easy to finance and cash flows more valuable. Brexit has not had a negative impact as depreciated GBP has made cost for foreign tourists more affordable.

India Opportunity - Multibagger Formula Ramdeo Agarwal

India is currently in economic crisis and currently offers the best investment opportunity in the world due to banking crisis and a slowdown. India will emerge stronger with a middle class of 1 Billion Plus over the next decade.

The opportunity is if the scale of crisis of 2016 in Brazil, 2009 in US and 2012 Euro Crisis.

Global Investors including Brookfield, Blackstone, Qatar, UAE, Singapore Sovereign Funds, CPPIB are actively looking for investments.

Britain's Cineworld to buy Cineplex for US$1.64B

Britain's Cineworld to buy Cineplex for US$1.64B. Cineplex to be acquired by U.K.'s Cineworld for C$2.15 billion. 42% premium. Although the price has been depresses over last 3 years. They also bought a US company 1-2 years ago and are now largest movieplex operator in North America. Cineplex has 70% market share in Canada. In US Cineworld owned Odeon and other brands control roughly 50% share with China’s Dailan Wanda controlled AMC is the other big player.

91 Fortune 500 Companies Paid $0 Federal Taxes in 2018

Nearly 100 Fortune 500 companies effectively paid no federal taxes in 2018. Many of these companies are profitable ams growing and pay $0 tax in US and many also skirt taxes globally.

Includes some of the top companies AMZN, SBUX, DE, NFLX.

91 of Fortune 500 companies $0 Tax

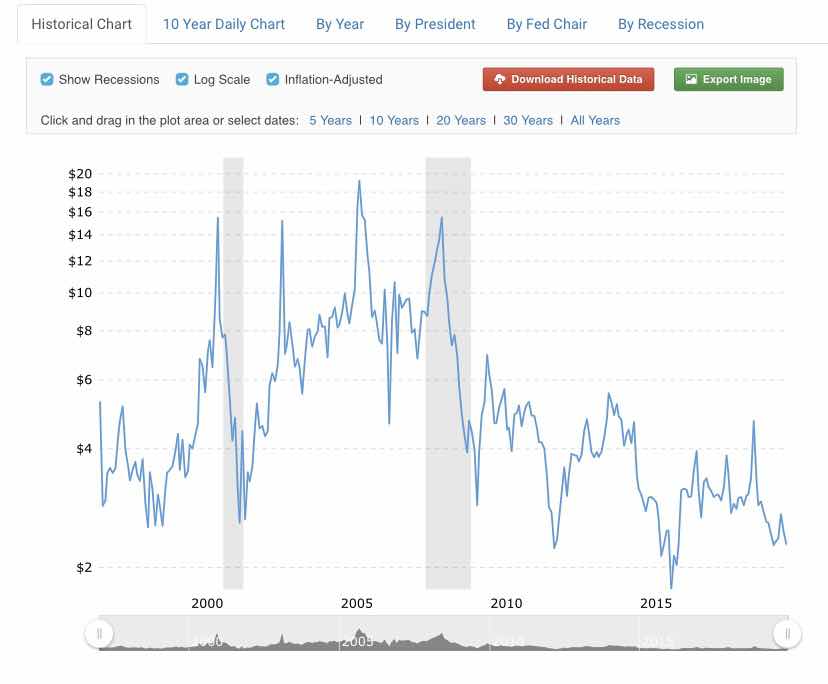

Perils of Commodity Investing - Natural Gas Over Last 10 Years

Perils of Commodity Investing is again reiterated by Natural Gas Over Last 20 Years. The price has has wild swings due to change in weather cyclically and shale revolution. Price has ranged between $18 and $2.

Money can be made at cyclical lows and price currently at $2 offers that opportunity.

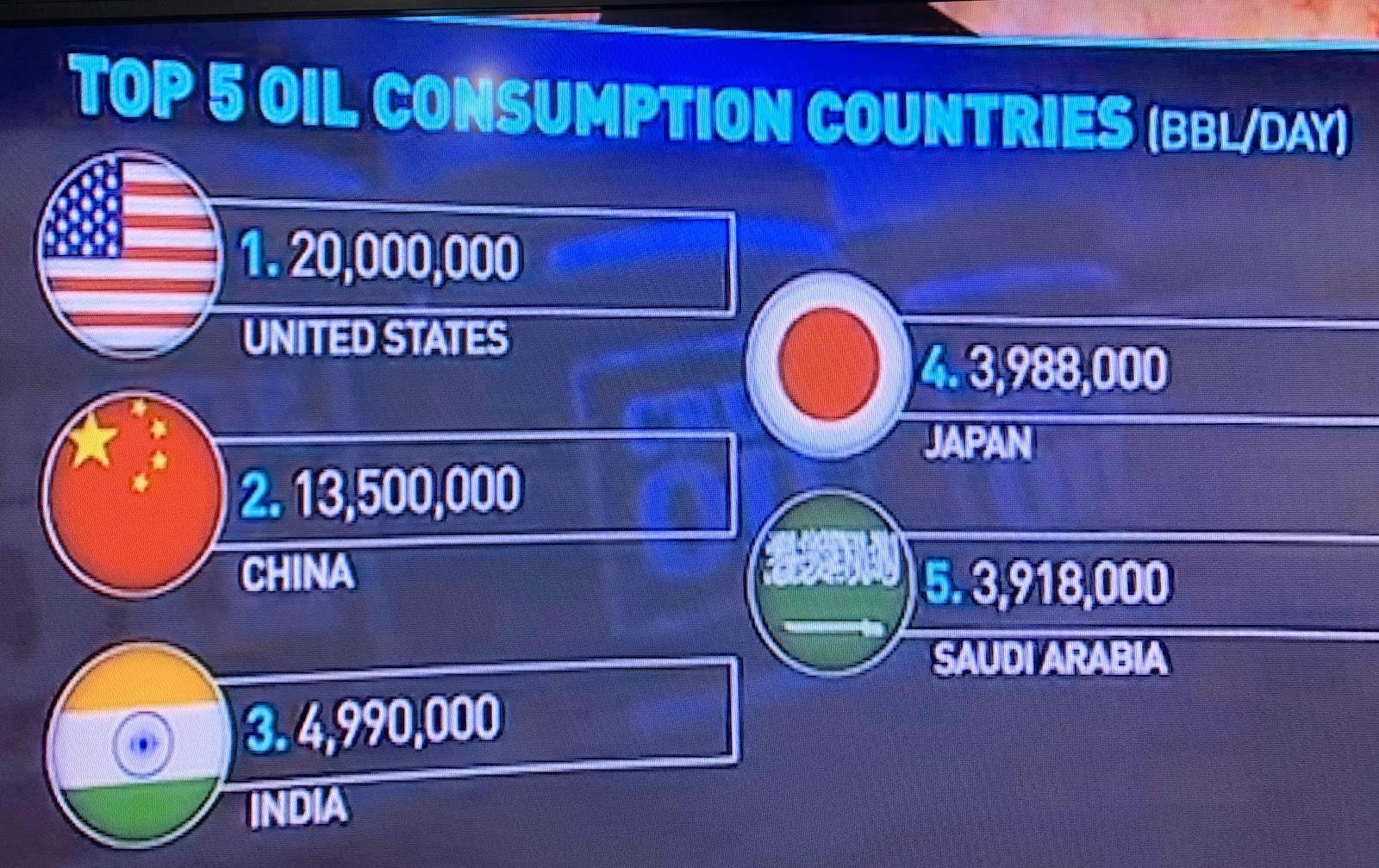

Oil Market Analysis - Top Consumers to Create a Block

Top Consumers who are also top importers India and China to Create a Block. Japan and South Korea also could join. This would form a counter balance to OPEC, Russia and US who have had influence on global oil prices.

Currently US is still top consumer of oil with 20M Barrels/day (8 M is imported and 12M is produces locally). China daily consumes 13.5M (Imports 8M) and India daily consumes 5M(Imports 5M). However US consumption is growing at 0.5% while China is growing at 5% and India could grow between 5-10%. So over next 2-3 decades China and India are the markets to be and hence Saudi Arabia, Russia are making strategic moves to lock in deals with India, China and also Japan and South Korea.

Inspire of Electric vehicles taking market share Oil is here to stay for next 3-5 decades.

Currently US is still top consumer of oil with 20M Barrels/day (8 M is imported and 12M is produces locally). China daily consumes 13.5M (Imports 8M) and India daily consumes 5M(Imports 5M). However US consumption is growing at 0.5% while China is growing at 5% and India could grow between 5-10%. So over next 2-3 decades China and India are the markets to be and hence Saudi Arabia, Russia are making strategic moves to lock in deals with India, China and also Japan and South Korea.

Inspire of Electric vehicles taking market share Oil is here to stay for next 3-5 decades.

Sunday, December 15, 2019

QIA picks up 25% in Adani’s Mumbai power utility for $450M

QIA picks up 25% in Adani’s Mumbai power utility for $450M Valuing the business at $1.8B. The assets used to belong to Anil Ambani who was forced to sell in 2016.

AEML supplies power to 3M people in Mumbai and accounts for 55% of electricity supplies to city and covers 87% of area. Assets include generation and transmission lines.

QIA picks up 25% in Adani’s Mumbai power utility for $450M

AEML supplies power to 3M people in Mumbai and accounts for 55% of electricity supplies to city and covers 87% of area. Assets include generation and transmission lines.

QIA picks up 25% in Adani’s Mumbai power utility for $450M

Lyft Announces Car Rental Service - Hertz and Avis Shares Plunge

Lyft Announces Car Rental Service - Hertz and Avis Shares Plunge.

Lot of disruption killing the car rental business.

Lot of disruption killing the car rental business.

Stephen Schwarzman – Blackstone CEO and Author of "What It Takes" - Interview

Fantastic Interview of Stephen Schwarzman Blackstone CEO recently Authored a book "What It Takes". Interview is conducted by Goldman Sachs CEO David M Solomon.

Insightful stories and inspirational. Covers Schwarzman's first job as a kid, how he was Rejected by Harvard and went to Yale and how he started Blackstone.

Stephen Schwarzman – Blackstone CEO and Author of "What It Takes" - Interview

"What It Takes" Book

Insightful stories and inspirational. Covers Schwarzman's first job as a kid, how he was Rejected by Harvard and went to Yale and how he started Blackstone.

"What It Takes" Book

Veritas Insights: Canadian Housing Market Perspectives

Report Covers the following:

• The impact of the B20 mortgage stress test;

• The economics of condo rentals in the GTA;

• The constraints within the new construction market, including red tape;

• Why there is a rush to apartment development;

• The danger that real estate investors exacerbate a house price correction;

• The danger that real estate investors exacerbate a house price correction;

• The expectation for increased volatility in the Vancouver condo and housing market;

• The truth behind the rapidly growing shadow mortgage market;

• How foreign investors are laundering through our Canadian banking system;

• A bubble of stretched consumers;

• Sidewalk Labs and potential innovations in urban planning and construction.

Best Performing Stocks is Last Decade

Best Performing Stocks is Last Decade Span across all sectors. So winners can come from anywhere.

2009 was a very special time with many companies trading at irrational prices so that needs to be kept in mind.

2009 was a very special time with many companies trading at irrational prices so that needs to be kept in mind.

Best Performing Stocks is Last Decade

Wednesday, December 11, 2019

OECD Electricity-Energy Mix Last 30 Years

OECD Electrify-Energy Mix Last 30 Years Shows decrease for Coal and Nuclear and gains for Renewables (Solar+Wind+Hydro) and Natural Gas.

Looking ahead to next 20 years it is likely Coal May go away and Nuclear will decline as Renewables will gain major share and Natural Gas will continue share growth assuming low Natural Gas prices remain.

Looking ahead to next 20 years it is likely Coal May go away and Nuclear will decline as Renewables will gain major share and Natural Gas will continue share growth assuming low Natural Gas prices remain.

OECD Electricity-Energy Mix Last 30 Years

US 10 Year Treasury Yield - Forecast vs Actual Last 10 Years

US 10 Year Treasury Yield - Forecast vs Actual Last 10 Years

For 2019 forecast was for 10 year bond yield to reach 3.5% to 4% but is ending the year closer to 1.75%. The same was the issue in 2013 Sep when emerging markets crashes on expectations for 4% to 5% US 10 year bond yields but it never came to pass.

Forecasting is a tough business! Meanwhile risk takers in Real Estate and stocks have been richly rewarded over last 5 years. Even Bond investors have seen gains as falling yields have boosted the price of the bonds.

For 2019 forecast was for 10 year bond yield to reach 3.5% to 4% but is ending the year closer to 1.75%. The same was the issue in 2013 Sep when emerging markets crashes on expectations for 4% to 5% US 10 year bond yields but it never came to pass.

Forecasting is a tough business! Meanwhile risk takers in Real Estate and stocks have been richly rewarded over last 5 years. Even Bond investors have seen gains as falling yields have boosted the price of the bonds.

Chevron to sell its 50% stake in Canada’s Kitimat LNG Project

Chevron (CVX) to sell its 50% stake in Kitimat LNG project. The Flight of Capital from Canada’s Energy Industry continues unabated as the incompetence of Trudeau government and lack of business friendly policies continues.

Chevron to sell its 50% stake in Canada’s Kitimat LNG Project

Chevron to sell its 50% stake in Canada’s Kitimat LNG Project

Glimmers of Hope Appear for Brazil’s Toxic Water - Long Runway of Growth for BBU’s Brazil Water Utility BRK Ambiental

Glimmers of Hope Appear for Brazil’s Toxic Water - Long Runway of Growth for BBU’s Brazil Water Utility BRK Ambiental.

Long Runway of Growth for BBU’s Brazil Water Utility BRK Ambiental which is 70% owned by Brookfield with other 30% owner by Brazil Employees Pension Fund.

Glimmers of Hope Appear for Brazil’s Toxic Water

Long Runway of Growth for BBU’s Brazil Water Utility BRK Ambiental which is 70% owned by Brookfield with other 30% owner by Brazil Employees Pension Fund.

Glimmers of Hope Appear for Brazil’s Toxic Water

Boeing - A Look Back at the 737 MAX Grounding

Boeing (BA) - A Look Back at the 737 MAX Grounding

The BA 737 MAX was grounded in Mar 2019 and it seems unlikely that the plane will be back in the air even 1 year after the grounding. This raises major concerns on the design of the BA 737 MAX as the regulators globally will be looking very closely at the plane. There is some risk whether the issues will be fixed with software and if hardware design change is required it will be a huge blow to BA.

BA is still at a market cap of $195B and an enterprise value of $220B with $25B debt. There could be many penalty payments to airlines for the grounding and delays which could be drag on near time earnings.

If MAX is certified soon and deliveries resume and there are no more issues then BA EPS could return to $20 and then grow from there. The company has a fantastic competitive position as a duopoly with Airbus and has a stable legacy Jet and US defense business. The current price of $340 discounts a lot of potential future growth and a company backlog of $470B as of 3Q2019.

As of now BA is a watch and there could be a reasonable entry point on next market correction or if further unexpected MAX delays are announced.

Selling Jan 2022 puts for $350 at a premium of $62 allows an entry price of $290 per share and a $170B market cap valuation. Selling puts on further correction of BA to $320 could allow for an entry with $150B market cap which could allow for lower risk.

The BA 737 MAX was grounded in Mar 2019 and it seems unlikely that the plane will be back in the air even 1 year after the grounding. This raises major concerns on the design of the BA 737 MAX as the regulators globally will be looking very closely at the plane. There is some risk whether the issues will be fixed with software and if hardware design change is required it will be a huge blow to BA.

BA is still at a market cap of $195B and an enterprise value of $220B with $25B debt. There could be many penalty payments to airlines for the grounding and delays which could be drag on near time earnings.

If MAX is certified soon and deliveries resume and there are no more issues then BA EPS could return to $20 and then grow from there. The company has a fantastic competitive position as a duopoly with Airbus and has a stable legacy Jet and US defense business. The current price of $340 discounts a lot of potential future growth and a company backlog of $470B as of 3Q2019.

As of now BA is a watch and there could be a reasonable entry point on next market correction or if further unexpected MAX delays are announced.

Selling Jan 2022 puts for $350 at a premium of $62 allows an entry price of $290 per share and a $170B market cap valuation. Selling puts on further correction of BA to $320 could allow for an entry with $150B market cap which could allow for lower risk.

Brookfield in Talks to Inject $800M in Indian Renewable Power Producer 'ReNew Power Ltd'

Canada's Brookfield Asset Management Inc (TSE:BAM.A) is holding talks to inject $800M in Indian Renewable Power Producer 'ReNew Power Ltd'.

Goldman Sachs Group Inc (NYSE:GS) currently owns more than 48% in ReNew Power. Other investors in the Indian firm are Abu Dhabi Investment Authority (ADIA), the Canada Pension Plan Investment Board (CPPIB), the Asian Development Bank (ADB), Global Environment Fund and Japan’s JERA.

ReNew Power, India's largest renewable energy independent power producer (IPP), owns over 8 GW of wind and solar assets across the country, either commissioned or in development, as of June 2019.

Brookfield in Talks to Inject $800M in Indian Renewable Power Producer 'ReNew Power Ltd'

Brookfield, Others Are Playing The Long Game In India’s Tricky Renewables Market

Canada's CPPIB, Brookfield eyeing more than $1 bn investment in ReNew Power

ReNew Power Ltd

Goldman Sachs Group Inc (NYSE:GS) currently owns more than 48% in ReNew Power. Other investors in the Indian firm are Abu Dhabi Investment Authority (ADIA), the Canada Pension Plan Investment Board (CPPIB), the Asian Development Bank (ADB), Global Environment Fund and Japan’s JERA.

ReNew Power, India's largest renewable energy independent power producer (IPP), owns over 8 GW of wind and solar assets across the country, either commissioned or in development, as of June 2019.

Brookfield in Talks to Inject $800M in Indian Renewable Power Producer 'ReNew Power Ltd'

Brookfield, Others Are Playing The Long Game In India’s Tricky Renewables Market

Canada's CPPIB, Brookfield eyeing more than $1 bn investment in ReNew Power

ReNew Power Ltd

Sunday, December 8, 2019

US Stocks Totally Outperform Global and Emerging Market Stocks Over Last 10 Years

US Stocks Totally Outperform Global and Emerging Market Stocks Over Last 10 Years.

A $100 invested in US SnP 500 Index is worth $280 after 10 years. In US$ terms Global Stock Index gets you $125 and in Emerging Market stocks has seen also no gains.

The main reasons for this are US has strong companies, has focus on innovation and SnP has some of the tech and global champions. Europe and Asia and Emerging Markets companies have not innovated as much, currencies have weakened a lot and Emerging Markets were overvalued relatively speaking and some have too much commodity concentration.

Next 10 years many people expect the story to reverse. I for one are am unsure. Currency trends may reverse but as long as interest rates are low US companies will continue to deliver relatively reasonable returns. Returns over 10 years will definitely be below par compared to last 10 years.

A $100 invested in US SnP 500 Index is worth $280 after 10 years. In US$ terms Global Stock Index gets you $125 and in Emerging Market stocks has seen also no gains.

The main reasons for this are US has strong companies, has focus on innovation and SnP has some of the tech and global champions. Europe and Asia and Emerging Markets companies have not innovated as much, currencies have weakened a lot and Emerging Markets were overvalued relatively speaking and some have too much commodity concentration.

Next 10 years many people expect the story to reverse. I for one are am unsure. Currency trends may reverse but as long as interest rates are low US companies will continue to deliver relatively reasonable returns. Returns over 10 years will definitely be below par compared to last 10 years.

Vodafone Idea Will Close If Government Doesn't Provide Any Relief

India regulators did a bad thing letting Jio so unfair practices (unsustainable low prices) when it launched 2-3 years ago. We need capitalism to work naturally without govt intervention and favoritism.

Maybe govt will need to waive the dues for taxes and spectrum to help these mobile companies survive. India needs at least 3 players Jio, Airtel, Idea-Vodaphone.

Vodafone Idea Will Close If Government Doesn't Provide Any Relief: Kumar Mangalam Birla

Maybe govt will need to waive the dues for taxes and spectrum to help these mobile companies survive. India needs at least 3 players Jio, Airtel, Idea-Vodaphone.

Vodafone Idea Will Close If Government Doesn't Provide Any Relief: Kumar Mangalam Birla

Canada's bankers face the bleakest bonus year in almost a decade

Canada's bankers face the bleakest bonus year in almost a decade.

I love the Canadian banks in terms of their shareholder friendliness and how they are managed conservatively. Canadian Banks are preparing well for a potential downturn if it does occur by cutting costs and increasing efficiency. They have also diversified their business over last 15 years with US exposure and going into new avenues of growth including wealth management.

They all pay 50% of earnings mostly as dividend and do some share buybacks and invest the rest in growth. They also innovate and adopt tech quickly so that they don’t get disrupted. They have done the same for last 100 years.

Canada's bankers face the bleakest bonus year in almost a decade

I love the Canadian banks in terms of their shareholder friendliness and how they are managed conservatively. Canadian Banks are preparing well for a potential downturn if it does occur by cutting costs and increasing efficiency. They have also diversified their business over last 15 years with US exposure and going into new avenues of growth including wealth management.

They all pay 50% of earnings mostly as dividend and do some share buybacks and invest the rest in growth. They also innovate and adopt tech quickly so that they don’t get disrupted. They have done the same for last 100 years.

Canada's bankers face the bleakest bonus year in almost a decade

Tuesday, December 3, 2019

Google Co-Founders Page, Brin Give Up Management Roles, Google CEO Sundar Pichai to Lead Alphabet

Google Co-Founders Page, Brin Give Up Management Roles, Google CEO Sundar Pichai to Lead Alphabet.

Google Co-Founders Page, Brin Give Up Management Roles, Google CEO Sundar Pichai to Lead Alphabet

Google Co-Founders Page, Brin Give Up Management Roles, Google CEO Sundar Pichai to Lead Alphabet

Vladimir Putin, Xi Jinping launch 'historic' Russia-China Gas Pipeline - $400B 30 Years Gazprom Deal

$400B deal for Gazprom for 30 year supply of natural gas to China from Russia.

Russia also has TurkStream pipeline for Gas from Russia to Turkey and Southern Europe using pipes under the Black Sea and also has NordStream-2 pipeline project that expands supply to Germany and Western Europe bypassing Ukraine.

Putin is doing a good job and making Russia Great Again. The $40B pipeline was constructed and went live in 5 years time. It is disappointing to see Canada dither and waste the Energy advantage over the last 5 years as no Oil or Gas pipelines have been built to export product from Alberta to International Markets.

Vladimir Putin, Xi Jinping launch 'historic' Russia-China Gas Pipeline - $400B 30 Years Gazprom Deal

Russia also has TurkStream pipeline for Gas from Russia to Turkey and Southern Europe using pipes under the Black Sea and also has NordStream-2 pipeline project that expands supply to Germany and Western Europe bypassing Ukraine.

Putin is doing a good job and making Russia Great Again. The $40B pipeline was constructed and went live in 5 years time. It is disappointing to see Canada dither and waste the Energy advantage over the last 5 years as no Oil or Gas pipelines have been built to export product from Alberta to International Markets.

Vladimir Putin, Xi Jinping launch 'historic' Russia-China Gas Pipeline - $400B 30 Years Gazprom Deal

Market Outlook for Next 12 Months

Markets are unpredictable so anything can happen.

Having got that out of the way my sense is that most likely US Stock market for next year could be flat. The reason being that recent run up in stock market has stretched the market multiple and almost all stocks are trading at Fair Value or Above Fair Value.

Lot of news including US-China Trade Stalemate (or what’s termed as Phase 1 deal) is baked in. It is likely that interest rates will remain in this 1.5% to 2% for US 10 year range for the foreseeable future.

I still think the best path forward is to stay invested and incrementally invest savings over the year at a steady rate with caution and not taking too much risk. Value of a stock can fall 10-20% in a year but over 5 years and 10 years time-frame good companies will compound value. A downturn in near term may even enhance long term value for companies that are opportunistic in their investments and those than can do accretive share buybacks.

In Tech AMZN looks favorable to AAPL on a relative value basis. GOOGL and FB are fairly valued assuming strong growth over next 5 years materializes and regulatory risks remain in check.

On a sector basis Energy is cheaper and can perform better in 2020 assuming Oil demand remains stable and supply remains at current levels. Banking is another sector where multiple expansion is possible.

In consumer staples sectors MO is still a good pick with possible multiple expansion to 14 P/E and $59 stock price. In consumer discretionary EXPE is a good pick with $140-$160 Fair Value assuming a reversion to 20 times multiple and no entry by GOOGL, FB, AMZN into Travel Bookijng sector.

Having got that out of the way my sense is that most likely US Stock market for next year could be flat. The reason being that recent run up in stock market has stretched the market multiple and almost all stocks are trading at Fair Value or Above Fair Value.

Lot of news including US-China Trade Stalemate (or what’s termed as Phase 1 deal) is baked in. It is likely that interest rates will remain in this 1.5% to 2% for US 10 year range for the foreseeable future.

I still think the best path forward is to stay invested and incrementally invest savings over the year at a steady rate with caution and not taking too much risk. Value of a stock can fall 10-20% in a year but over 5 years and 10 years time-frame good companies will compound value. A downturn in near term may even enhance long term value for companies that are opportunistic in their investments and those than can do accretive share buybacks.

In Tech AMZN looks favorable to AAPL on a relative value basis. GOOGL and FB are fairly valued assuming strong growth over next 5 years materializes and regulatory risks remain in check.

On a sector basis Energy is cheaper and can perform better in 2020 assuming Oil demand remains stable and supply remains at current levels. Banking is another sector where multiple expansion is possible.

In consumer staples sectors MO is still a good pick with possible multiple expansion to 14 P/E and $59 stock price. In consumer discretionary EXPE is a good pick with $140-$160 Fair Value assuming a reversion to 20 times multiple and no entry by GOOGL, FB, AMZN into Travel Bookijng sector.

Mastercard OKs $8B Stock Buyback, Raises Dividend 22%

MA and V keep rolling and staying ahead of disruption and growing revenue and earnings.

MA is worth ~$300B now and V is worth ~$400B now. Trading at 30+ times forward earnings with still a long runway of growth in the multi $T electronic payments space.

Mastercard OKs $8B Stock Buyback, Raises Dividend 22%

MA is worth ~$300B now and V is worth ~$400B now. Trading at 30+ times forward earnings with still a long runway of growth in the multi $T electronic payments space.

Mastercard OKs $8B Stock Buyback, Raises Dividend 22%

Sunday, December 1, 2019

Saudi Arabia Aramco IPO Draws Bids of $44.3 Billion

Saudi Arabia Energy Giant Aramco IPO Draws Bids of $44.3 Billion. The energy giant’s valuation of $1.6 to $1.7 trillion has been set by the Saudi government. The IPO is mostly purchased by local investors and is expected to start trading from Dec 04 2019.

Subscribe to:

Posts (Atom)