Mritik Capital values BRK.B shares to be valued between $230 to $250. An investor in BRK benefits from access to $185B of Equity Assets ($75 per share), $132B in Cash and Fixed Income Assets (~$54 per share) and has access to 80 child companies that are fully owned which produce significant operating earnings of $20B+ ($8.13+ per share) and the best insurance franchise in the world with float of $122B (~$50 per share). The $20B operating earnings ($8.13 per share) comprises of $9.4B in Manufacturing, Service and Retailing, $5.3B in BNSF Railroad, $2.6B in BH Energy, $2.3B 10 year average annual Insurance Underwriting, $0.5B in Finance and Financial Products. BRK also has Corporate Debt excluding Railroad and Utilities of $35B ($14.2 per share) and $51.4B of Deferred Income Tax Liability ($20.9 per share) and $120B of Insurance Long Term Liability ($48.8 per share).

Mritik Capital currently values BRK by adding up the parts $75 + $50 + 16*8.13 - 14.12 -0.20*20.9 - 0.20*48.4 = $255.08 - $27.98 = ~$227.

Mritik Capital projected value at 2019 end for BRK by adding up the parts $81.3 + $55 + 16*8.75 - 14.12 -0.20*24 - 0.20*50 = $276.30 - $28.92 = ~$247.

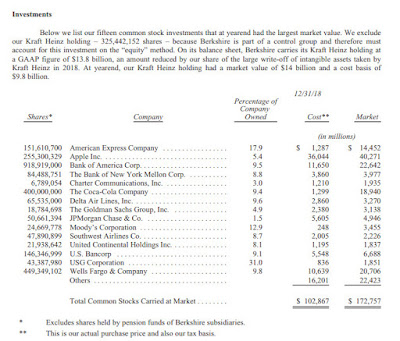

Below are select details from 2018 year end financial report.

Note: The deferred income tax and insurance liability are long term and are discounted ti be at a 15% rate. If BRK does not sell shares they never need to pay the tax and also new insurance premiums each year offset payouts so float can be perpetual or long lasting.

BRK 2018 Annual Results

No comments:

Post a Comment